Kinder Morgan (NYSE:KMI) continued its forward progress in the second quarter. The natural gas pipeline giant reported $1.1 billion ($0.50 per share) in distributable cash flow (DCF), which was 9% ahead of the year-ago quarter. That result was also slightly ahead of the company's guidance that it would haul in about $1.05 billion, or $0.48 per share of DCF during the quarter, which, when combined with its forecast-beating results to start the year, has it on pace to meet or exceed its full-year guidance.

Kinder Morgan Inc. results: The raw numbers

Data source: Kinder Morgan Inc. Chart by author.

What happened with Kinder Morgan this quarter?�Natural gas pipelines led the charge.

Kinder Morgan's natural gas pipeline segment delivered an "outstanding quarter," according to President Kim Dang. Earnings improved 11% year over year because of increased activity across nearly all its large pipeline systems, with transportation volumes up 12% versus the year-ago quarter. Earnings in its carbon dioxide segment rose slightly, helped by a 4% increase in oil production and higher commodity prices. Product pipeline earnings jumped 10% thanks to increased performance across nearly all its segments, with a 10% uptick in ethanol volumes and a 5% improvement in oil volumes helping lead the way. Earnings in the terminals segment rose 3%, mainly because of contributions from its liquids business. Not only did the company benefit from a 3% increase in storage at its key hubs in Houston and Edmonton, but earnings also got a boost from new tankers delivered in 2017. Contributions from Kinder Morgan Canada Limited's (TSX:KML) Trans Mountain Pipeline rose 7% year over year, mainly because of how the company capitalized costs for that pipeline's expansion project. However, the company did agree to sell that pipeline and the associated expansion project to the Government of Canada during the quarter, which will affect future results.

Image source: Getty Images.

What management had to say�Founder and Executive Chairman Richard Kinder commented on the quarter:

The board is very pleased with the company's progress during the quarter. We continue to aggressively de-lever even while maintaining our planned substantial dividend increase. We ended the quarter with a net debt-to-adjusted EBITDA ratio of 4.9 times and expect to end the year below our 2018 budgeted leverage metric of approximately 5.1 times, excluding any impact from the use of Trans Mountain sale net proceeds. We also continue to develop very attractive growth projects that build on our extensive North American energy infrastructure network. During the second quarter, we announced the joint development of the Permian Highway Project, which will provide a greatly needed associated-gas takeaway solution for producers.

Aside from posting solid results, Kinder highlighted two key points. First, Kinder Morgan continued to improve its financial profile by de-levering its balance sheet, which is ahead of plan. As he pointed out, the company's leverage ratio was below its forecast during the quarter, which puts the company on pace to exceed its objective for the year. In fact, it could push leverage down to 4.5, according to analysts, if it uses the proceeds from its Trans Mountain sale to pay off debt.

In addition, the company continues to find needle-moving expansion projects, having recently unveiled the development of the Permian Highway Pipeline Project. Kinder Morgan is developing the $2 billion natural gas pipeline with private equity-backed EagleClaw Midstream and Apache Corporation (NYSE:APA). It's a follow-up to the Gulf Coast Express Pipeline (CGX), which is a $1.75 billion gas pipeline it's building with two other midstream companies and Apache. Kinder Morgan has already started work on GCX, which should be in service by October 2019, while PHP could follow a year later if the company gives it the green light. These projects will help offset some of the growth it will lose by selling Trans Mountain.

Looking forward�After a solid showing in the second quarter, Kinder Morgan is on pace to produce at least $4.57 billion, or $2.05 per share, in DCF this year, and push its leverage ratio below 5.1. However, there is a major unknown lurking over the horizon because of the pending sale of Kinder Morgan Canada's Trans Mountain Pipeline, which should close by the early part of the fourth quarter at the latest. Kinder Morgan has a variety of options for the cash it will receive, including using it to take Kinder Morgan Canada private, make acquisitions, pay down debt, or buy back stock.

Cheapcoin (CURRENCY:CHEAP) traded flat against the US dollar during the 1 day period ending at 0:00 AM Eastern on July 11th. Cheapcoin has a market cap of $0.00 and $0.00 worth of Cheapcoin was traded on exchanges in the last 24 hours. One Cheapcoin coin can currently be bought for $0.0003 or 0.00000004 BTC on major cryptocurrency exchanges. In the last week, Cheapcoin has traded flat against the US dollar.

Cheapcoin (CURRENCY:CHEAP) traded flat against the US dollar during the 1 day period ending at 0:00 AM Eastern on July 11th. Cheapcoin has a market cap of $0.00 and $0.00 worth of Cheapcoin was traded on exchanges in the last 24 hours. One Cheapcoin coin can currently be bought for $0.0003 or 0.00000004 BTC on major cryptocurrency exchanges. In the last week, Cheapcoin has traded flat against the US dollar.

YHB Investment Advisors Inc. acquired a new position in shares of Liberty Latin America Ltd Class C (NASDAQ:LILAK) in the 2nd quarter, Holdings Channel reports. The fund acquired 15,368 shares of the company’s stock, valued at approximately $298,000.

YHB Investment Advisors Inc. acquired a new position in shares of Liberty Latin America Ltd Class C (NASDAQ:LILAK) in the 2nd quarter, Holdings Channel reports. The fund acquired 15,368 shares of the company’s stock, valued at approximately $298,000.

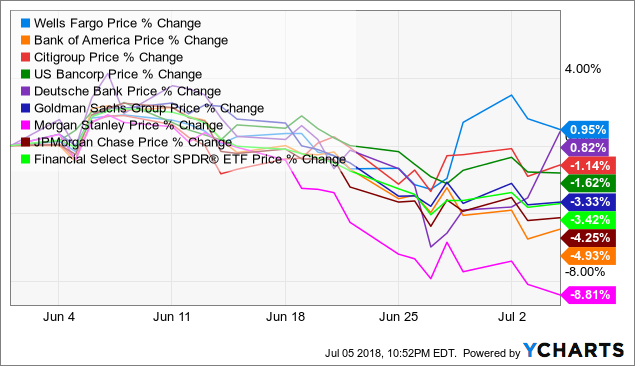

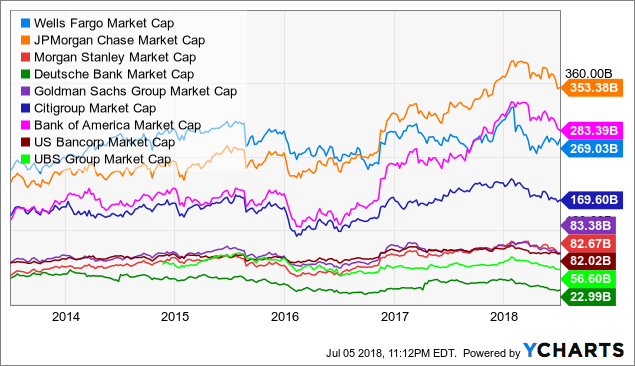

WFC data by YCharts

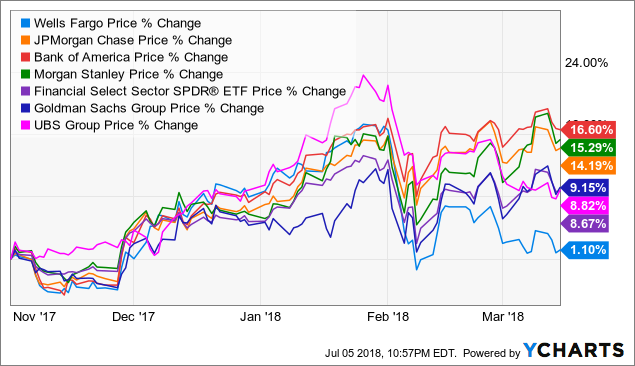

WFC data by YCharts WFC data by YCharts

WFC data by YCharts WFC data by YCharts

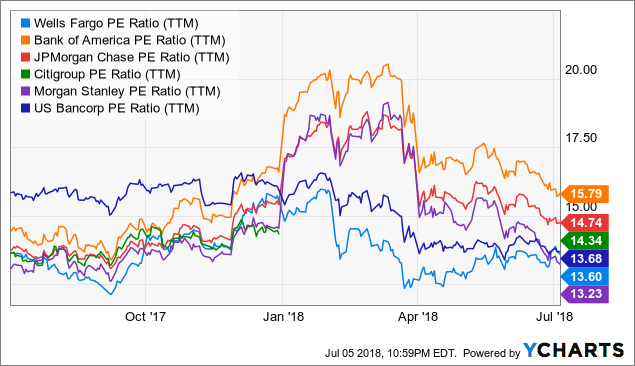

WFC data by YCharts WFC PE Ratio (NYSE:TTM) data by YCharts

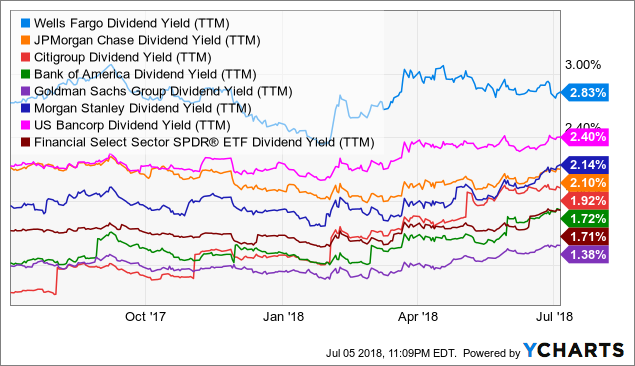

WFC PE Ratio (NYSE:TTM) data by YCharts WFC Dividend Yield (TTM) data by YCharts

WFC Dividend Yield (TTM) data by YCharts WFC Market Cap data by YCharts

WFC Market Cap data by YCharts WFC data by YCharts

WFC data by YCharts